There are a couple of international money transfer companies that you can choose from if you are looking for the cheapest way to send money to the Philippines (for your relatives, for example) or pick up money from relatives (from abroad). If you are torn between InstaREM or Remitly or even World Remit, bear in mind that these three service providers are reliable and are cost-effective compared to some online services.

All these international money transfer services have similarities as to how they operate. But, like all business transactions, there are those teeny tiny details that you have to look into because they might be something that does not work for you or for the person or people whom you’d be receiving the remittance. Sometimes, you get to choose which one is best depending on how much you’re going to send and how fast you want or need it to reach its destination.

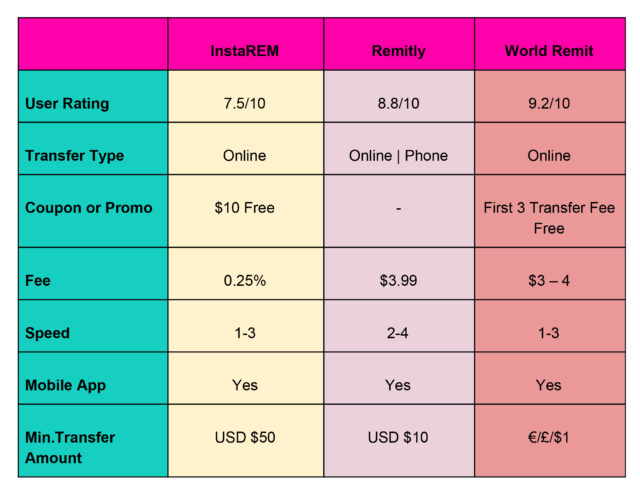

These details include their user ratings, the exchange rates, their fees, the countries they provide service to, how convenient the service is for both parties (sender and receiver), security, and if they have discounts or promos. Now, let us compare these companies for us to be able to delve on it.

Comparison

User Ratings

Just looking at the user ratings, we can see that World Remit has a bigger percentage compared to the other two. Compared to InstaREM and Remitly, World Remit’s bank transfer fee is cheaper than the other two. Of course, this all depends on where you’re sending it and how much it is. Plus, World Remit is faster. Because World Remit has multiple payment methods (bank transfer, cash pick-up, mobile money, airtime top-up, and home delivery), you can transfer money instantly unlike the other two which need 1-4 business days before it is cleared.

Transfer Type

Looking at the transfer type of these three, we can see that Remitly has a phone option, which is a good thing if you like doing things on-the-go. But, for the most part, people still prefer looking at a wider screen (computer) when doing money transactions just because sometimes there are tons of things to type.

Coupons or Promos and Fees

For the coupons or promos, it’s only Remitly that does not offer one. For InstaREM, you get a $10 use ICOMPARE10 for your first transfer and World Remit offers your first 3 transfer fee for free using code: 3FREE. Note that the zero transfer fee code is applied in the payment process in the ‘PROMO CODE’ section of your first three transfers. Not bad, right?

Mobile Apps

We already talked about how fast the services are for each service provider, but let me just say that according to the chart we have above, all three have mobile apps – personally, I haven’t checked them out yet but it’s to know that there is always somewhere you can check while you’re looking at your phone.

Minimum Transfer Amount

On the last item we have on the chart, we see the minimum transfer amount that each service provider has, USD $50 for InstaREM, USD $10 for Remitly, and €/£/$1 for World Remit.

There you have it guys, a quick delve on the three money transfer companies – InstaREM, Remitly, and World Remit. All these have their pros and cons, and as a consumer, it is our task to check on them before doing any transaction with them. But these three are the cheapest way to send money to the Philippines. However, bear in mind that vigilance is always key when we deal with our hard-earned money.